WHY DO COMPANIES NEED THIRD-PARTY RISK MANAGEMENT - TPRM IN USA?

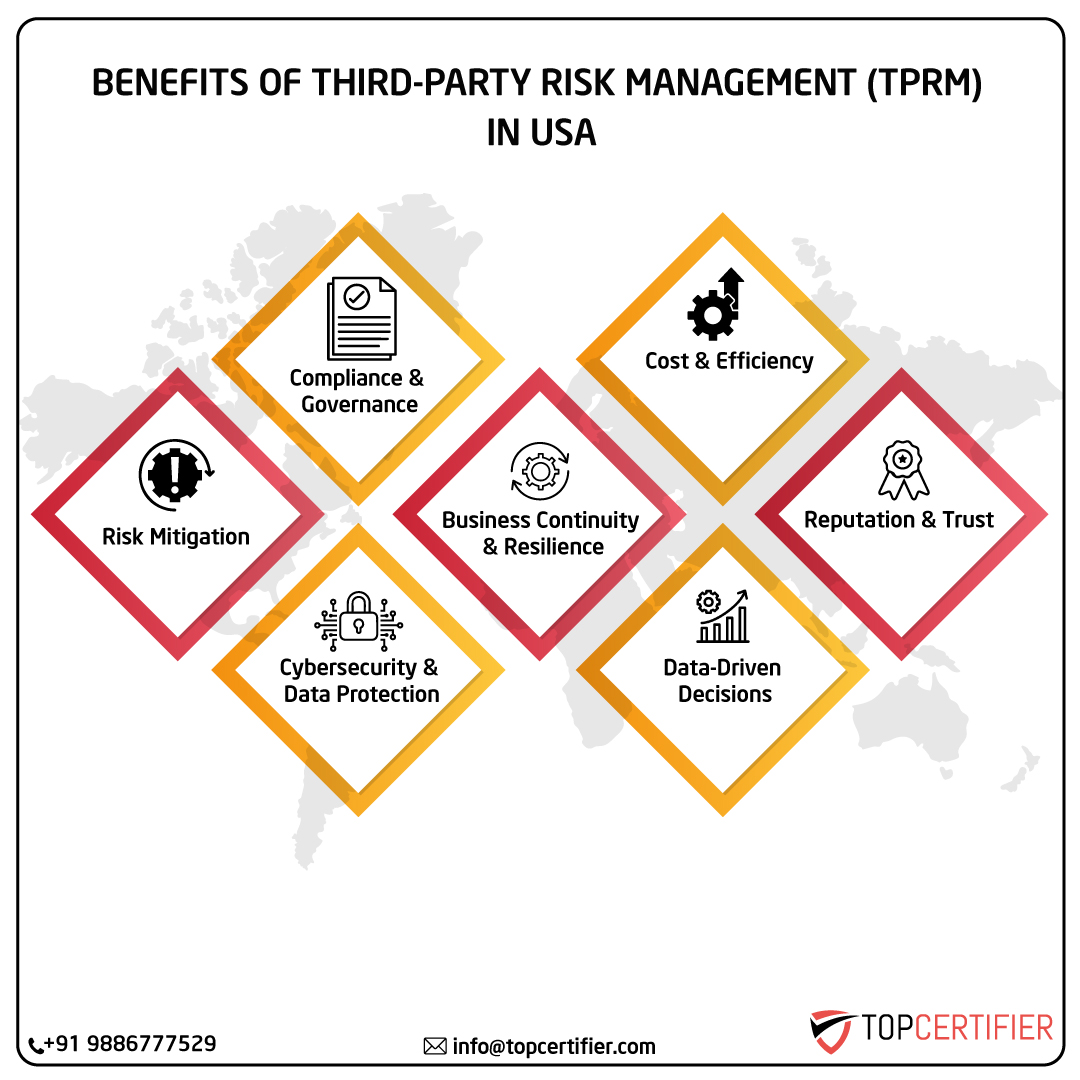

Third-Party Risk Management - TPRM in vital Americans markets such as New York and Los Angeles, is the ultimate solution for protecting businesses, staying compliant, and finding business risks caused by third parties. As businesses grow, TPRM helps tackle cybersecurity, operational failures, and reputational damage across sectors from finance to manufacturing to tech.

In regions like New York, Los Angeles, Chicago, Houston, Phoenix, Philadelphia, San Antonio, San Diego and Washington, TPRM ensures third-party collaborations meet regulatory standards and align with business goals. It reflects a company’s commitment to secure operations, sustainable partnerships, and long-term growth.

ESSENTIAL RESOURCES FOR SECURITY & COMPLIANCE IN USA

Third-Party Risk Management (TPRM) Service

Strengthen your vendor risk management with our comprehensive TPRM service, ensuring third parties meet regulatory and security standards while minimizing risks.

Security Information and Event Management (SIEM) Service

Enhance threat detection and response with our SIEM solutions, providing real-time security monitoring and data analytics for compliance and risk mitigation.

SOC & NOC Services

Ensure continuous protection and operational efficiency with our 24/7 SOC and NOC services, delivering real-time threat monitoring, incident response, and network performance optimization.

SOC as a Service (SOCaaS)

Access scalable and cost-effective SOC as a Service, providing managed threat intelligence, incident detection, and response without the overhead of an in-house SOC team.

NOC as a Service (NOCaaS)

Ensure maximum network availability and performance with our NOCaaS, offering proactive monitoring, issue resolution, and infrastructure management.

Compliance & Financial Reporting Solutions

SSAE 18 & SSAE 16 Reports – Achieve transparency and assurance in third-party risk management and financial reporting.

ISAE 3402 & ISAE 3000 Reports – Validate control frameworks and risk management practices for global compliance.

SOX Compliance & Attestation – Ensure adherence to the Sarbanes-Oxley Act with reliable audits and compliance assessments.

US GAAP Audit & Reporting – Maintain financial accuracy and integrity with US GAAP-compliant reporting and audit services.

TPRM SERVICES IN USA BY THE BEST THIRD-PARTY RISK MANAGEMENT CONSULTANT IN USA

As a leading third-party risk management (TPRM) consultant in USA, Topcertifier provides end-to-end solutions for businesses to assess, mitigate, and manage third-party risks. Our TPRM services in USA include:

Conducting a detailed third-party risk gap analysis to identify weaknesses in your TPRM framework, ensuring compliance with regulatory standards and industry best practices.

Evaluating third-party vendors, suppliers, and contractors for operational, compliance, cybersecurity, financial, and reputational risks. We provide in-depth third-party risk assessments to help organizations strengthen their vendor management strategies.

Helping organizations in USA implement strong third-party risk management policies and procedures that align with global compliance standards such as ISO 27001, NIST, and SOC 2.

Providing specialized TPRM training in USA to educate employees on vendor risk management, cybersecurity risks, and third-party compliance. Enhance awareness and ensure third-party risk mitigation across your organization.

Conducting internal audits to assess the effectiveness of your third-party risk management framework, ensuring compliance with global risk management standards such as ISO, GDPR, HIPAA, and SOC 2.

Assisting organizations with third-party risk audit preparation by identifying compliance gaps, strengthening security controls, and ensuring readiness for regulatory inspections and audits.

A comprehensive TPRM lead auditor training program in USA, designed for professionals looking to master third-party risk audits. Learn best practices for conducting vendor audits, assessing risk controls, and ensuring compliance.

Designed for professionals responsible for implementing TPRM frameworks, this training focuses on building an effective third-party risk management system, ensuring regulatory compliance and robust security controls.

Organizations partnering with Topcertifier have successfully met the third-party risk management compliance requirements of leading certification bodies such as BSI, SGS, TUV, DQS, and Bureau Veritas. Additionally, our services align with accreditation bodies such as IAS, JAS ANZ, UKAS, and ANSI.

Trust Us To Lead The Way In Certification And Compliance

Knowledge And Expertise

Thorough Understanding Of The Framework, Its Requirements, And Best Practices For Implementation

Proven Track Record

Successful Track Record Of Helping Clients Achieve Compliance, With Positive Client Testimonials And Case Studies.

Strong Project Management Skills

Ensure The Compliance Engagement Runs Smoothly And Is Completed On Time And Within Budget.

Experienced Team

Possession Of Experienced Professionals, Including Auditors, Consultants, And Technical Experts

Exceptional Customer Service

Committed To Excellent Customer Service With Clear Communication, Responsive Support, And A Focus On Satisfaction.

Competitive Pricing

We Prioritize Delivering High-Quality Services With Competitive Pricing That Provides Exceptional Value To Our Clients

FAQs

FREQUENTLY ASKED

Financial Risk Management in Banking refers to strategies and procedures used to identify, measure, and reduce risks related to market rapidity, fluidity, and operational failures. Banks implement risk management structures to ensure compliance with financial rules and to protect property against economic uncertainties and fraud.

The main objectives of third-party risk management in USA revolve around identifying, assessing, and mitigating risks that arise from engaging with external vendors, suppliers, or partners. Here's a humanized breakdown of its core objectives:

Identifying Potential Risks:

The first step is to understand who your third-party partners are and what they bring to the table. This includes assessing risks related to data security, regulatory compliance, financial stability, operational processes, and reputational concerns.

Evaluating and Assessing Risks:

Once risks are identified, TPRM focuses on evaluating the level of risk each vendor poses. This involves conducting thorough risk assessments, audits, or security reviews to gauge their risk posture.

Mitigating and Managing Risks:

After understanding the risks, organizations work to minimize them. This may include negotiating strong contracts, setting up contingency plans, or ensuring that third parties comply with specific security standards.

Monitoring and Reviewing Relationships:

Risk is dynamic, so TPRM involves continuous monitoring of third-party relationships. This ensures that any emerging risks are quickly identified and effectively managed over time.

Ensuring Compliance and Regulatory Adherence:

Many industries are governed by strict regulations. TPRM ensures that third parties meet legal and regulatory standards, helping organizations avoid heavy fines and reputational damage.

Safeguarding Reputation and Trust:

By effectively managing third-party risks, companies protect their brand image, maintain customer trust, and build strong partnerships.

In essence, TPRM in USA isn't just about checking boxes—it’s about building a proactive defense mechanism that ensures external collaborations contribute to business growth without exposing the organization to unnecessary risks.

The responsibility for TPRM usually comes under the risk management, compliance, procurement, and legal teams of the organization. In large companies, a dedicated TPRM team or the Chief Risk Officer(CRO) oversees third-party risk assessment. However, senior leadership and individual business units also play a role in implementing policies and ensuring vendor compliance.

Effective TPRM in USA follows a structured process, which includes:

1. Risk Identification – Evaluate any dangers associated with outside vendors.

2. Due Diligence & Vendor Selection – Assess outside vendors according to their operational dependability, security, compliance, and financial stability.

3. Risk Assessment & Categorization – Classify vendors based on the level of risk they pose to the business.

4. Contract Management & Compliance Review – Ensure agreements include security, compliance, and risk management clauses.

5. Ongoing Monitoring – Keep track of vendor activities, audits, and performance reviews.

6. Incident Response & Remediation – Address security breaches, regulatory violations, or operational failures promptly.

Similar to general third-party risk management, TPRM is managed by:

● Chief Risk Officer (CRO) / Risk Management Team

● Compliance & Legal Teams

● Procurement & Vendor Management Teams

● IT & Cybersecurity Teams (for technology-related risks)

● Audit & Internal Controls Teams

Yes, TPRM in USA is an important component of Governance, Risk, and Compliance (GRC). This aligns with GRC principles by ensuring that third-party businesses compliance with regulatory requirements, risk management policies, and corporate administration standards. A strong TPRM program helps organizations to manage the seller risks efficiently within its broad GRC framework.

TPRM is essential because:

● It protects against third-party vendors’ data breaches, fraud, and operational failures.

● It makes sure your data is compliant with regulations such as GDPR, ISO 27001, and SOC 2.

● It lowers financial risks, cybersecurity risks, reputation risks, legal risks etc.

● It encourages trustworthy and secure collaborations with suppliers and vendors.

Some of the most common third-party risks include:

● Cybersecurity threats (data breaches, hacking, malware attacks)

● Non-compliance with regulatory requirements (failing to comply with standards for the industry)

● A notable increase in the financial risk (or bankruptcy) of the vendors.

● Operational failures (supply chain or service delivery interruptions)

While all industries benefit from TPRM in USA, it is especially critical for:

● Banking & Financial Services (due to regulatory compliance and fraud risks)

● Healthcare (for protecting patient data and ensuring HIPAA compliance)

● Technology & IT Services (for cybersecurity and data privacy concerns)

● Manufacturing & Supply Chain (to prevent disruptions and ensure quality control)

● Retail & E-commerce (for vendor risk in supply chain management)

● Reviewing economic health (credit rankings, stability).

● Conducting cybersecurity assessments (penetration testing, security regulations).

● Evaluating regulatory compliance (certifications like ISO 27001, SOC 2).

● Performing operational risk analysis (business continuity plans, service reliability).

Organizations use various frameworks and standards for TPRM, including:

● ISO 27001 – Information security management.

● NIST Cybersecurity Framework – Guidelines for cybersecurity risk management.

● SOC 2 Compliance – Security, availability, processing integrity, confidentiality, and privacy standards.

● GDPR – Data protection regulations for third-party vendors handling personal data.

● Implement a proper vendor risk management framework.

● Use automated tools for real-time vendor monitoring.

● Conduct regular audits and risk assessments.

● Train employees on third-party security risks.

● Establish a vendor offboarding procedure to mitigate post-contract risks.

TPRM in USA ensures that third-party vendors meet industry regulations and standards such as:

● SOX - Sarbanes-Oxley Act for financial reporting.

● HIPAA for healthcare data security.

● PCI DSS for payment security compliance.

● FCPA - Foreign Corrupt Practices Act for anti-bribery laws.